By: Bashir Mohamed

Introduction

Before I look Somaliland Fiscal Year Budget 2021 in detail, I must say a word or more about the definition of budget. A budget is a financial statement of estimated revenue and expenses based on future plans usually a year and goals of a government for a certain period. In other words budget is the annual financial plan or economic strategy for the nation, it shows how revenue will be raised, and how these funds will be used to address specific needs of the country. Also, the budget is an annual statement of a country’s expected revenue and expenditure. It is the most important tool that the government uses to translate the development aspirations of the nation into reality.

The budget helps the government to prioritise the different needs of the country; whether it is strengthening the economy, maintaining security, promoting good governance, empowerment of provinces and districts, supporting vulnerable sectors, or improving livelihoods- and make sure the responsible ministries, departments, agencies or programmes get to access to the resource they need. The budget is prepared to present the government’s revenues and spending plans to accelerate the socio-economic transformation that the government uses to allocate public resources among identified priorities agreed upon through different consultative forums where citizens participate. The parliament approves the budget at the central level and the district council for decentralized entities. On 8th Dec 2020, Minister of Finance Dr Sacad Ali Shire presented fiscal year budget 2021 to the House of Representatives.

Article 55 (sub-4) of the Constitution mandates the executive branch of the government to prepare the annual fiscal budget as well as the ensuing final accounts, while the House of Representatives reviews, debates and has the power to make amendment before it is finally approved. Therefore, in this report by using budget data from the 2021 Financial Year, we will make a number of analyses regarding the budget source of revenues, allocations, spending priorities and mismatches. Also, we focus on efficiency, effectiveness, transparency, prioritization of expenditure rationalization activity, service and projects, Where the increase will come, how the regions and departments allocated in the FY of Budget 2021.

Budget and Economic Overview

Somaliland is an independent state in the Horn of Africa which stands for peace, democracy, stability, prosperity, and cooperation in the region, officially declared independence from Somalia in 1991. Somaliland has open borders and an open economy, its heavily dependent on international trade (specially import goods), livestock, remittance, and grants. It shares boundaries with Djibouti on the West, Ethiopia in the South, Somalia in the East, and Yemen to the North.

Somaliland’s GDP amounted to $2.5 billion with GDP per capita estimated yearly at $566 and on living less than $1.5 per day (PPP). The 2020 GDP growth rate was recorded slightly decline but projected to grow at a conservative rate of 2% per year in the mid-term of 2021. Almost 30% of GDP is derived from livestock followed by 24% from trade, 22% from remittance, 8% from crops, 7% from tax revenue, 6% from real estate activities and 3% other sectors1. While the state lacks official international recognition, the population of around 4 million, food insecurity and poverty remain prevalent in many regions of the country more than 1 of 3 people in rural and more than 1 of 4 people in urban living poverty. Furthermore, it has very low levels of investment and low employment to population ration, with 28% for males and 17% for females2.

According to the Africa Development Bank, (Economic Outlook Paper) East Africa is leading the continent in economic development with an estimated GDP growth of 5.1% in 2020 (pre Covid-19), followed by North Africa with an estimated GDP growth of 4.9%. West Africa comes in 3rd with 3.3% GDP growth, followed by Central Africa with a 2.2% growth and Southern Africa with a 1.2% estimated GDP growth. Rwanda is in the lead as the fastest growing economy with a predicted 7.8% economic growth in 2021, while Ethiopia is a close second at 7.2%; Tanzania follows at 6.6%; Kenya at 6%, Djibouti at 5.9%, Uganda at 5.3% and the Somalia economy was expected grow by 2.9%. All East African countries were projected to positively contribute to the growth, expect for Sudan whose economy was projected to slow by 1.6% in 2020 due to conflict. The region’s growth is largely driven by strong public expending in infrastructure, rising domestic demand, the benefit of improved stability, new investment opportunities and incentives for industrial development3.

Somaliland economy has been hit hard by Corona Virus, locust, pilgrimage restrictions and traffic disruptions. In the first six months of the previous year recorded a trade deficit of $161 million and decline of 7.5%, imported $230 million worth of goods and exported $230 million. Due to the country high depend on imports, this was led to instability and imbalance trade.

For the fiscal year 2021, the average inflation rate is projected at 6.4% and it is expected to be contained in the medium term at 4.5% in 2021. In October 2020, the exchange rate against the US dollar was 8,560 SLSh/USD, up from the 8,470 SLSh/USD recorded in Sept—representing a 0.9% depreciation. The currency shilling was fairly stable between November and December 8,500 SLSH/USD and 8,600 SLSH/USD.

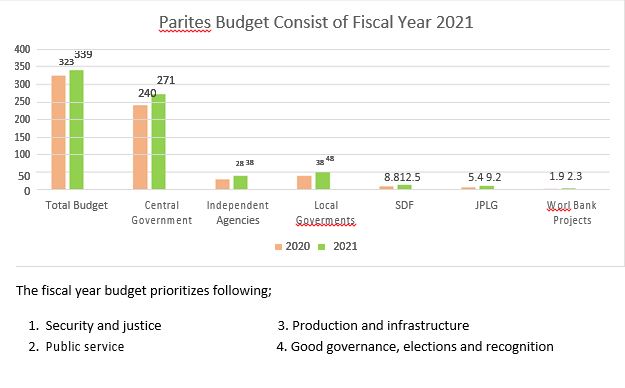

The Somaliland Budget for the fiscal year 2021 amounts to $339 million, this represents an increase of 2.9% from the previous fiscal year budget. The budget consists of six codes; central government budget was allocated $247.2 Million which is 2.7% higher than 2020, independent governments agencies $29.1 million, local governments had a budget of $43.3 million, SDF $10.4 million, World Bank projects $7.5 million, and JPLG are $1.5 million, which shall account for 72.9%, 12.8%, 8.5%, 2.3% 3.07% and 0.43% of the total budget respectively. The budget continues to follow an upward trend for the past five years. The 2021 had increased a whopping 117% from 2015 when the actual budget was $156.1 million.

Tax revenue and non-tax are expected to constitute 94% of the budget, with the remaining portion of 6% being expected to be financed from external sources comprising of grants. The main source of revenue for the year will be 41.1% import tax, good and services tax 15.0%, sales tax 17%, administrative tax 5.2%, civil service 5%, property tax 5%, profit tax 2%. These taxes 60% while representing more than total domestic revenue collection.

Figure 4 Source of tax revenue

Somaliland budget is based on the recurrent expenditure or operational cost of the government, structurally is a comprehensive budget, but the process it uses is called a line-item budgeting system. The internal revenue collection process is a regionalized system, but in management, revenue is the centralized system. The centralized system provides more economic power and benefit to the capital as more than 75% of it will be spent, also, Somaliland the allocation way of municipal budgets does not base on population and district needs.

Revenue Analysis

Somaliland government receives different revenue from different sources. Domestic revenue is the engine that drives government operations, social service (public service) and infrastructure development. More than three of the fiscal year budget will come from 94% of internal revenue in the form of taxation, the remaining 6% will come from donor countries and international organizations in the form of assistance.

Somaliland is very reliant on revenue from customs duties and various fees and levies on imports; is the source of income most powerful resource of government get. Overall revenue for the 2021 budget comprises $247 million which is 3.9% more than in the previous year. The main income in the budget are customs account the largest amount 76% of $193.2 million, while Inland Revenue contributes only 18% of $44.6 million and the rest contain 6%. Taxes charged on imports (custom taxes) claims the largest source of taxes Somaliland has 20 customs, the four largest customs with 96% revenue is Berbera 66.4%, Kalabaydh 21.2%, Zeila 6%, Hargeisa 2.4%, Borama 1.2%, Togwajaale 1.1% and other customs 1.6%. figure 6 and table 1 illustrate the income estimates for the six regions, it’s important to note that this revenue expect for customs and inland revenue.

From 2010 there has been a concerted effort to increase the tax revenue between 2010-2020 the annual real growth rate of the overall tax in the country was more than 20%. The largest geographical sources of internal revenue from the regions of Maroodijeex $79M, Saaxil $136.8M, Awdal $16.7M, Togdheer $2.4M, Sool $1.5M, Sanaag $0.75M and ministries $9.4M.

The above table shows the estimated revenue from six regions, 85% coming from the Western Regions while less than 1.6% will come from Eastern Regions. Awdal region’s projected income for the year will $16.7 million, which is down -3.1% while the target for 2021 was $19 million, all other regions show a slight increase in revenue as will expected.

Figure 7 Revenue allocated to come six regions in the form of taxation

Table below also shows the revenue projected to the ministries, grants, balance treasury, port rent etc.

local governments budget was estimated for the total budget will $43.3 million, of this 77.5% came from income from taxes, fees, fines and penalties collected by municipalities and the 22.5% remaining receive two main types of fiscal transfer from the central government. The first is a transfer from the Ministry of Finance that comprises 10% of the revenue it collects from all customs duties within administrative boundaries of the districts. The second form of intergovernmental fiscal transfer amount of 12.5% from Central Government to local governments to support the development of the districts as well as provide equalization but divided according to article 89 (sub-2), Law No.23/2019 states district A 6%, district B 2%, district C 3%, and district D 1.2%. expenses not covered by revenues. Some districts more than 50% of their municipal budgets receive from fiscal transfer in the central government, which 50+ of their budgets form of subsidy for example Berbera and Gabiley.

When you look at the income that municipalities receive from taxes that law allows same way, the amount of tax depends on the size of town, population density and consumption commodities. Therefore, region with larger population has more taxpayers than others.

The local governments in terms of allocation Berbera allocated $12.4M of budget, Hargeisa $11.6M, Borama $2.4M, Burco $3.2M, Lascanod $1.8M, Gabiley $4.6M, Saylac $1.4M, Erigavo $1.2M, and other projected $4.7M. 67% of LGB will be spent in Hargeisa, Berbera and Gabiley.

The local governments in terms of allocation Berbera allocated $12.4M of budget, Hargeisa $11.6M, Borama $2.4M, Burco $3.2M, Lascanod $1.8M, Gabiley $4.6M, Saylac $1.4M, Erigavo $1.2M, and other projected $4.7M. 67% of LGB will be spent in Hargeisa, Berbera and Gabiley.

Expenditure Analysis

Government expenditure in 2021 compared to 2018 significantly increased for each major spending line- with the exception of loan repayment. Allocation spend figures for compensation of employees, use of goods and service, and assets increased the most in absolute terms. When you read the budget statement of GoS, you find that 85.9% of the total budget are salaries, allowances, utility expenditure, travel expenses, maintenance vehicle’s, repair buildings and machinery and repayment of the national loan. All of this is not relating to any development of the country but are the only operational cost of the government.

Lastly years owing to expenditure growing at a faster pace than revenue, budget implementation has resulted to budget deficits. In FY2021, $127.7 million allocated to spend on compensation of employees, representing 51.6% of total expenditure, its higher than 2020’s 3.2%, more than half of the government’s underspend in 2021 will go to salaries and allowances. On another hand $63.02 million will to spend operational cost 26.18% of total expenses in 2021, slightly higher the previous year 1.5%.

Expenditure projected on subsidies will allocate $5.6 million (2.4%), government subsidies come in the form of Budget Subsidy and a Food Price Subsidy. The budget subsidy is a contingency for any expenditure line that was not budgeted for while the food price subsidy is used to support the army in times of significant food price increases.

Fixed assets forecasted amount to $38.87 million (5.2%) and loan repayment on domestic debt will $8.8 million equivalent to a reduction of 3.6%. Heads of contingency fund and treasury balance are projected at total of $7.7 million. Development projects show a slight decrease of – 3.1%, were only allocated 8% of the budget which is a low allocation compared to government expenditures on recurrent activities that account for more than 73% of the total budget.

The chart below explains the bugdet partners acress the ministries and agencies of the country are aggregated and divided into 11 part partners such as security and defence 35%, administration 20%, economy 14.8%, education 9.2%, health 5.2%, infrastructure 4.7%, production 2.5%, environment 1.4%, water 1.1%, energy 0.65% and other sectors 4.8%.

The fiscal year proportion of regions taxpayer 2021 budget target estimated of $339, $71.2M or 21% of the total budget will come from taxpayers in Awdal region, $125.4M or 37% will come from Maroodijeex, in the amount of $61M will from taxation collection the people of Togdheer region, Sool will generate 10% or $34M projected revenue taxation, $27.1M which is equivalent to 8% of the total tax coming from Sanaag, and the Sahil region its taxpayer will pay $20.3M in tax at the rate of 6% of the total budget allocated (Quantitative Scenario Model).

Priority for Social Service

The prioritizing basic service that backbone of society is the number one priority for any government in the world to provide adequate services depending on the country’s economic energy. Somaliland is one of the countries with low social service and its annual budget allocation is relatively small compared to its peers, but joint efforts by civil society, government and international organizations are working together to provide effective and reliable service. The sectors of education, Health and Water are the foundation of life in society, the fiscal year budget allocated 16% for total budget 2021. This shows that the government will not do much better for social service this year.

Health

Health is one of the necessary basic needs of human life. The FY2021 budget allocation for upgrading, improving and expanding health services in Somaliland is 5.2% of the total budget of $12.9 million, up from 4.72% last year. The $12.9 million allocations will be shared by the health sector institutions including Ministry of Health ($11,403,308.8), Quality Control Commission ($759,585.7), Somaliland National HIV/ADIS Commission ($484,368.6), and the Health Professionals Commission ($285,082.8), as shown below the figure 11 Lack of quality of health and poor service to regional hospitals, lack of care for equipment and vehicles, low sanitation inwards, lack of ambulance’s in some districts/areas/hospitals, this budget planned health sector will not make a significant difference to the health service that Somalilander’s needs.

Education

Education is one of the most important determinants for an individual’s productivity and future success and is also the foundation of humanity; it guides for the human to the right path and way of success. Better educated citizens are the backbone for production and prosperous nation. Education is one of the key drivers of economic development, the budget allocated to Education sector FY2021, has shown a decrease 1.39% in this year, but normally government funds to the education sector have remained low. In 2021, the government of Somaliland has allocated $22.8 million to the education sector, a significant decrease up from $23.1 million last year. Within the region of Horn Africa, Somaliland aggregate education sector spending levels are very low. The UNESCO database of government expenditure, which uses education national accounts to allow for cross-country analysis, ranks Somaliland lowest among East African countries, with an investment in public education standing at less than 1 per cent of real GDP in 2017.

Consequently, the Ministry of Education increased primary school teachers’ salaries by 25%, and

hire an additional 300 primary school teachers to enhance the workforce. One major gap is that 95.4% of the sector budget goes to basic education, with higher education and university subsidies receiving only 4.6% of the total education budget.

Water

In Water is a basic right, it plays a crucial role in our lives. In past years GoS has carried out several national works geared towards the provision a safe water. 40% to 60% of people still lack of access to safe drinking water and often relay on open water sources like unprotected springs/wells, rainwater, gravity flows and dam water. Somaliland’s water sector is under intense pressure due to rapid population urban areas growth.

Subsidies for Non-state Actors

A review of the past three years shows that GoS support as assistance for the non-state actors the approved expenditure estimates have been growing in absolute terms; however, certain year have had high growth rates. The budget allocated subsidies for non-state actors are $5.7 million, which 2.3% of the total budget and the previous more than 2.91% which was $5.4 million. This financial allocation will be supporting specific organization in Hargeisa and other NGO’s cities of country no financial allocation was planned totally.

Judiciary Institutions

Supremacy of judiciary and rule of law it’s the way for the Somaliland to achieve better development and a fair. It’s very important for rule of law to reach different sections of the society at region and village levels, connecting and strengthening the legal chain from police investigations to courts are the backbone of justice process. The independence and transparency of the judiciary is paramount to governance. The key to good governance, and development is the rule of law and the equality of citizens. Partner agencies of the various branch’s judiciary fund allocated at $35.1 million of the total fiscal year budget. It’s small budget that does not contribute much to the expansion of justice system in the country, the capacity of the lower court staffs, and promotion rule of law.

Recommendation

-

The process of regulating budgets of local governments should be reformed and amended by the laws that was central to the economy, especially Law No.23/2019.

-

The government need to increase the resource mobilization efforts that will enable adequate funding for health, education, water, domestic production, and infrastructures.

-

Government should reduce unnecessary excessive expenses and should also further enhance the capacity of economy-forecasting bodies, in order to achieve accurate estimates of revenue and expenditures and to eliminate the perennial budgetary deficits.

-

The GoS should invest public spending infrastructure and domestic production. In order for the economic growth of the community, small fishing port should be established in Zeila and Lasqoray.

-

In the system of good governance, responsibility and accountability are inseparable, it’s essential Somaliland have an independent auditor, capable of conducting audits, monitoring, supervising, holding accountable and disclosing to the public and state annual financial statements in transparent manner.

-

Development project are only allocated 8% of budget 2021 which is a low allocation, the cost of the projects should increase at minimum 25%.

Read more here pdf: Somaliland Budget Analysis 2021

About the Author

Bashir Mohamed is the founders of ESAC, a commentator on economic, social affairs, and political in the Horn Africa. He holds BSc in Economics at Amoud University, Certified Firm Allocation and Marketing Economics at Illinois University, MBA candidate in Public Financial Accounting School of Post graduate Amoud University, Director of Smart Training and Consultancy. He has written more than

50+ articles in various fields.

ESAC Sheik Ahmed Salan Streat 03, Halane Area, Borama Somaliland

+252 63 4538873